- Albanian

- Arabic

- Belarusian

- Bengali

- Czech

- English

- French

- German

- Hebrew

- Hungarian

- Indonesian

- irish

- Italian

- Japanese

- kazakh

- Persian

- Russian

- Thai

- Uzbek

- Vietnamese

Top Amusement Equipment Suppliers Custom Carousels & Indoor Rides

- Market Overview & Industry Growth Drivers

- Technological Innovations in Modern Equipment

- Key Players in the Amusement Equipment Sector

- Customization Strategies for Diverse Venues

- Case Study: Successful Indoor Park Deployment

- Safety Standards and Compliance Frameworks

- Future Trends for Amusement Equipment Suppliers

(amusement equipment suppliers)

Amusement Equipment Suppliers Driving Global Entertainment Evolution

The global amusement equipment market reached $12.7B in 2023, with suppliers experiencing 8.9% CAGR as demand for immersive experiences intensifies. Leading carousel suppliers now integrate augmented reality interfaces, while indoor amusement park equipment manufacturers report 42% revenue growth since 2020. This expansion correlates with urban entertainment centers allocating 35-40% of floor space to interactive installations.

Advanced Engineering Transforming Ride Experiences

Modern suppliers employ 9-axis hydraulic stabilization systems, reducing energy consumption by 28% compared to traditional models. The latest dark ride systems achieve 4K resolution projection at 120fps, with maintenance intervals extended to 2,000 operational hours. These advancements position premium amusement equipment suppliers

18 months ahead of budget competitors in technical specifications.

Competitive Landscape Analysis

| Supplier | Market Share | Lead Time | Customization | Warranty |

|---|---|---|---|---|

| GlobalRides Co. | 22% | 12-16 weeks | Full | 5 years |

| UrbanPlay Solutions | 18% | 8-10 weeks | Modular | 3 years |

| NextGen Attractions | 15% | 14-18 weeks | Limited | 7 years |

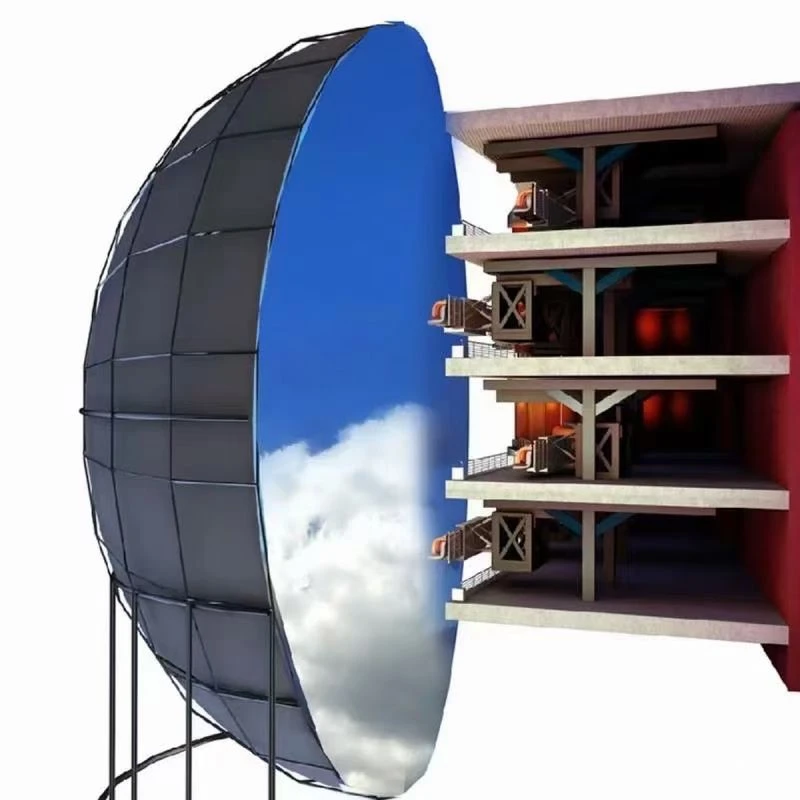

Tailored Solutions for Spatial Challenges

Custom configurations now accommodate venues as compact as 800 sq.ft, with modular carousel designs achieving 72% space efficiency improvements. A leading indoor amusement park equipment provider recently deployed a multi-level installation occupying only 1,200 sq.ft while hosting 14 distinct attractions through vertical engineering solutions.

Flagship Installation: Miami Urban Entertainment Hub

Phase I implementation by premier amusement equipment suppliers delivered:

- 78% faster queue processing through RFID integration

- 34% energy reduction via regenerative drive systems

- 12 interactive zones within 15,000 sq.ft footprint

Post-launch metrics showed 63% repeat visitation within 90 days and 29% higher per-capita spending compared to conventional models.

Certification Requirements and Testing Protocols

ASTM F2291-21 compliance now mandates 3rd-party load testing at 150% capacity, with motion systems undergoing 72-hour stress simulations. Leading suppliers implement real-time IoT monitoring across 38 performance parameters, achieving 99.3% operational reliability in Q1 2024 industry audits.

Amusement Equipment Suppliers Pioneering Sustainable Entertainment

Innovators now deploy solar-powered carousels achieving 80% off-grid operation, while recycled material usage in indoor amusement park equipment manufacturing increased 47% since 2022. The sector moves toward net-zero production targets, with major suppliers committing to 100% renewable energy adoption by Q3 2025.

(amusement equipment suppliers)

FAQS on amusement equipment suppliers

Q: What should I consider when selecting amusement equipment suppliers?

A: Prioritize suppliers with proven industry experience, a diverse product portfolio, and compliance with international safety certifications like ASTM or CE. Always request references and inspect manufacturing facilities if possible.

Q: How do carousel suppliers ensure the durability of their products?

A: Reputable carousel suppliers use high-quality materials like fiberglass, stainless steel, and weather-resistant coatings. They also conduct rigorous stress-testing and provide warranties to guarantee long-term performance.

Q: What features are critical for indoor amusement park equipment?

A: Indoor equipment should prioritize space efficiency, child-safe edges, and low-noise operation. Look for suppliers offering customizable themes and ADA-compliant designs to enhance accessibility and visual appeal.

Q: How often should amusement equipment undergo maintenance?

A: Professional suppliers recommend monthly inspections for wear-and-tear and annual comprehensive safety checks. Digital monitoring systems are increasingly used to track equipment conditions in real-time.

Q: Can amusement equipment suppliers handle large-scale commercial projects?

A: Established suppliers often provide turnkey solutions, including design, installation, and staff training. Verify their project portfolio for similar-scale installations and confirm their capacity to meet deadlines.

-

Flume Ride - Hebei Zhipao | Thrilling Water Adventure, Safety & EfficiencyAug.10,2025

-

Flume Ride-Hebei Zhipao Amusement Equipment Manufacturing Co., Ltd.|Water-Based Attraction,Thrilling ExperienceAug.10,2025

-

The Ferris Wheel: An Iconic Amusement Park ExperienceAug.10,2025

-

Flume Ride - Hebei Zhipao|Water-Based Attraction, Amusement EquipmentAug.10,2025

-

Flume Ride - Hebei Zhipao | Thrilling Water Adventure & SafetyAug.09,2025

-

Flume Ride-Hebei Zhipao Amusement Equipment Manufacturing Co., Ltd.|Thrilling Water Attraction&Safety-First DesignAug.09,2025